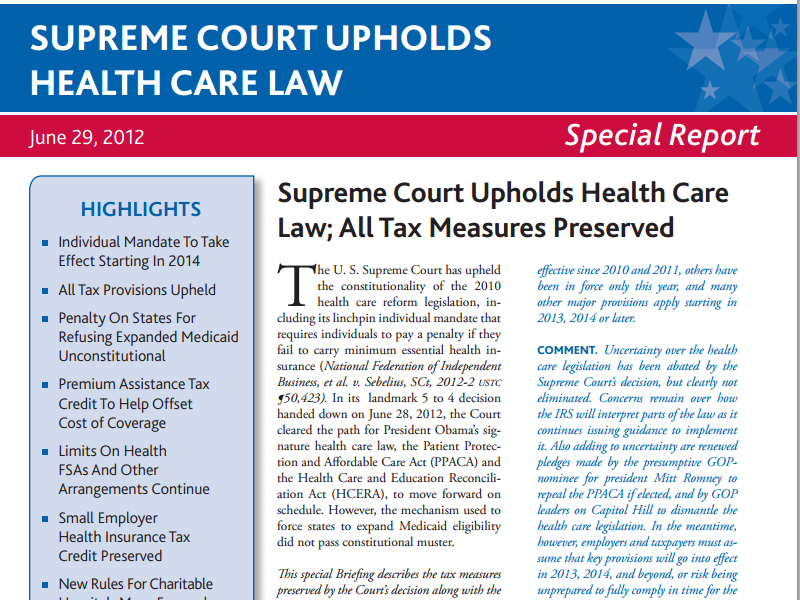

CCH, a Wolters Kluwer business, recently released a special Tax Briefing following the Supreme Court’s decision on the constitutionality of President Obama’s health care reform law. Supreme Court Upholds Healthcare Law; All Tax Measures Preserved focuses on the tax impact of the Court’s decision and provides related advice and tips.

In a historic 5-to-4 ruling, the Court found the law to be constitutional and concluded that it is within Congress’ authority to require individuals to pay a penalty for failure to carry the minimum essential health insurance. The Court decided that the Patient Protection and Affordable Care Act and the Health Care and Education Reconciliation Act should move forward. Additionally, it was decided that the methods used to impose expansion of state Medicaid benefits was unconstitutional.

“Many were surprised with what Chief Justice John Roberts wrote in his opinion, stating that imposing a penalty on individuals without health insurance is within the authority of Congress to levy taxes,” said Mark Luscombe, JD, LLM, CPA, and CCH Principal Federal Tax Analyst. “But it’s still not certain how the IRS will interpret parts of the law and, even with pledges by opponents to repeal the law, taxpayers have to assume key provisions will begin going into effect next year.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs